Child Tax Credit advocates: “We’re asking that we keep doing the thing that we knew was right in the first place.”

Editor’s note: Earlier this week, faith leaders gathered near the U.S. Capitol for a 12-hour vigil in support of President Biden’s Build Back Better plan pending in Congress. The “Keep the Faith Vigil” focused on so many issues close to the hearts of human needs advocates: hunger, housing, immigration reform, climate change, paid leave, tax credits for low-income families, home and community-based care, health care, labor rights, and more.

Voices for Human Needs listened in as three speakers discussed the expanded Child Tax Credit and Earned Income Tax Credit and emphasized why tax credits for Americans with low incomes simply must remain a part of the Build Back Better package. The three speakers were Rev. Dr. Starsky Wilson, President and CEO of the Children’s Defense Fund (CDF): Amelia Kegan, Legislative Director for Domestic Policy, Friends Committee on National Legislation (FCNL); and Deborah Weinstein, Executive Director, Coalition on Human Needs. The speakers’ remarks have been edited somewhat for brevity.

Rev. Dr. Starsky Wilson, Children’s Defense Fund: “Is a year long enough to make sure they have enough food to eat? Is a year long enough to make sure they have groceries in the cupboard?”

“…Here in this moment, in this time, in this place, reconciliation tends to be about resources. We understand it to be about relationship – being in right relationship with each other. And the caring, right relationship with children is one whereby we understand our hopes to be in them, so we place the treasures of our hearts and our time with them. And so, in this hour, in this hour, when we lift our hearts and our minds together in prayer, in this hour, where we lift our faces toward those in power, in this hour, we ask that we make relationship right with children by investing deeply in their future. And more than any other time, we’re not asking that we do something. We’re asking that we keep doing the thing that we knew was right in the first place.

Rev. Dr. Starsky Wilson, President and CEO, Children’s Defense Fund (photo by Nicolai Haddal)

“In the Child Tax Credit that has been expanded and adjusted for this year, lifting millions of children out of poverty, we have done the right thing. We have entered into right relationship. In doing so, we have lifted the hopes of four million children up and out of poverty for a time, and now we must consider how long that time will be.

“Is a year long enough to cut child poverty in half or to 40 percent? Is a year long enough to bring the hopes of children who have been wondering whether they would have access to out-of-schooltime activities…? Is a year long enough to make sure they have enough food to eat? Is a year long enough to make sure they have groceries in the cupboard? If a year has not been long enough so far, then a year [must] be extended…

“I understand that when you have a 50-50 Senate, that makes it a little bit more difficult to get things done. But we as people of faith understand our highest responsibility to be in right relationship, to settle things and to use the concept of reconciliation to care for the least, the last, and the left out, and these are our children. And so, we say that a year has not been long enough to make sure that this works, and a year is not long enough for an extension of the Child Tax Credit. When 23 million children last year were not eligible because their families earned too little, a year is not long enough to set our relationship with these children aright. Two years, Senator Manchin, is not long enough to set our relationships aright…

“And we stand on behalf of the 140,000 children who have lost one of their (caregivers) in the context of the pandemic and say they need all the support they can (get) because we understand that raising, that nurturing, that caring for our children is, in and of itself, a work requirement. The means are not to be tested. Because the only means to care for children is an open heart and open arms. And so, if one desires to test the means of whether someone should get a tax credit because they are caring for children, they should not measure how hard they work in a workplace where someone pays them a wage, but rather test how wide open their arms are to children in their community, in their neighborhood, and in their homes. The means for caring for children is within our hearts and in our arms, and it is definitely within this building [ed note: nods in direction of U.S. Capitol] and in this budget.

“The test of means is the test of will, of privileged, well-educated, well-resourced public officials. The question is, do they have the caring hearts? And the open arms that it takes to make sure that our children are well?

“I had some really good talking points about the economic benefits of the Child Tax Credit…I had some wonderful talking points about the return on investment because there is no staff like the CDF staff who prepares me very well…But I stand today with people of faith on the value that children are a gift from God, and they are to be cared for…And so we don’t make the economic case that others know. We just appeal to the humanity of humans – and invite them to care for other small humans. Growing humans. Loving humans – who only want a caring adult in their lives, who only want that adult resource to be able to meet their basic needs. And we come to amplify their voices today and invite our colleagues, our friends, our comrades, to keep the faith, invest in children, extend the commitment, and show and share that children are the greatest treasure in this nation.

“We will extend our investment in them, and we will hold up our responsibility to raise a nation by investing in children. This is our commitment. This is our prayer. This is where we place and drop our bucket and we will stand with all who stand with those children. God bless you and God keep you is our prayer.”

Amelia Kegan, Friends Committee on National Legislation: “You are being called right now to help transform this nation.”

“As many of us have been saying and hearing, we are on the verge of one of the most historic, transformative policy advancements this country has seen in decades. The EITC and CTC provisions are huge. And we’ve been hearing all day, there is so much more in this bill. This legislation is historic, and when it comes to kids, the EITC and CTC provisions are really transformational. EITC for adults not raising children in their home – this is the population that always gets the least amount of support. We’ve heard many times about how the kid credit expansions could cut child poverty in half – do to child poverty what Social Security did to poverty rates among seniors. And now, with the monthly expanded CTC payments going out, we have the data to back up the common sense we already know: hunger goes down when families have more money to buy groceries. The number of adults living in households with kids that reported not having enough to eat fell about 3 million after the kid credit benefits started going out.

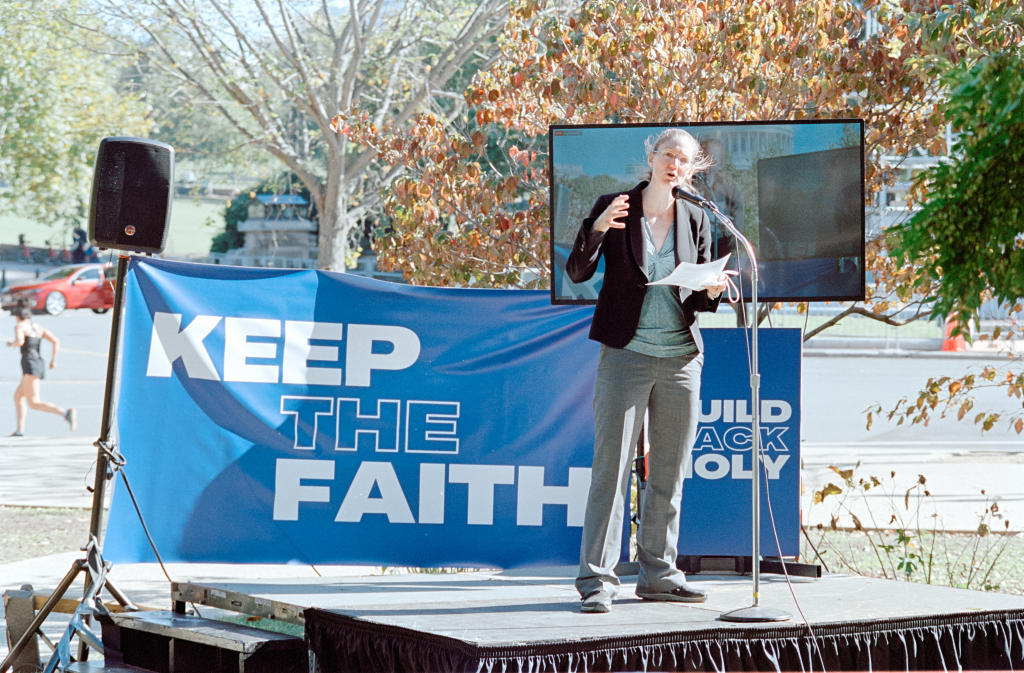

Amelia Kegan, Legislative Director for Domestic Policy, Friends Committee on National Legislation (photo by Nicolai Haddal)

“Right now, the tough decisions are being made in Congress around this bill: what gets cut and by how much? We need to ensure the strongest EITC and CTC (are) in this bill. We need permanent refundability for CTC in this bill so families with little or no income get the same benefits as wealthier families. The cost is minimal and it just makes sense.

“And this policy, this legislation, could come down to the next few days and couple of weeks. It might seem like the negotiations hinge on abstract numbers divorced from the actual reality of people who benefit. It might seem like the only people who matter are a senator from West Virginia and a senator from Arizona. It might seem like you can’t have an impact, but your voice is needed and important. And with such tight numbers in the House and in the Senate, members are being vocal about their priorities. Make this one of their priorities.

“Our country was designed for incremental change. But every so often, a moment arrives which provides a brief window of opportunity for dramatic progress. We’ve been enduring a lot. A global pandemic that has completely altered our way of life. Conspiracy theories over basic health protections like mask-wearing and vaccines. A society unable to seriously confront the enduring and continuing legacy of racism in this country. And I haven’t even started on the last four years of the Trump Administration.

“There can be no doubt: we are in a moment of history…This is the moment to band together, lobby together, work together, march together, pray together, lift each other up together, speak out together, rise up together, demand justice together…You are needed right now. You are being called right now to help transform this nation and create something more beautiful than was there before.”

Deborah Weinstein, Coalition on Human Needs: “The Child Tax Credit is making long-overdue progress in our shameful racial disparities”

Editor’s note: these remarks were prepared for delivery and may vary ever so slightly from the actual delivered address.

“We are doing something remarkably good in our nation now – we have started to invest in our children. Last Friday, the fourth monthly payment of the Child Tax Credit was distributed, and the number of children benefiting is growing, now to more than 61 million children, averaging $430 this month per family.

Deborah Weinstein, Executive Director, Coalition on Human Needs (photo by Nicolai Haddal)

“We know this money can make family life more stable and cut child poverty by about 40 percent. It is already doing this, and it is making long-overdue progress in our shameful racial disparities. According to the Congressional Research Service, the CTC in law now is reducing poverty among Asian children from 11 percent to 8 percent; Black children, 18 percent to 10 percent; Hispanic children, 20 percent to 12 percent; white children, 7 percent to 4 percent. Our nation needs this investment in our children to continue.

“The Child Tax Credit is doing a lot of good. We’ve heard stories of parents, some caring for children with disabilities, or having to stay home or work less because of the enduring pandemic, and grandparents raising their grandkids. They are able to get the school supplies their children need. We’ve heard from parents who haven’t received the Child Tax Credit yet and are first learning that they are eligible. One father said he’d spend some of the money on clothes, so his kids aren’t laughed at in school. And surveys show parents receiving the Child Tax Credit are putting food on the table.

“Nationally, after the CTC began to be distributed, 2 million fewer people living with children said their household didn’t have enough to eat in the previous week. Over the same period, the number of people without children saying they didn’t have enough to eat went up.

“The reduction in hunger is even greater in West Virginia than the national average. The Census Household Pulse survey has shown that, on average, households in West Virginia reported a decline in families reporting they don’t have enough to eat. Before families started getting the monthly CTC amounts, between late May and early July, 63,000 people reported being without enough to eat in the previous week – 14.5 percent of respondents. But after one or two payments, between late July and September, that number went down to 39,200 people – 9.4 percent of the respondents. That’s more than a one-third drop.

“We must never go back to telling families – ‘sorry, you’re too poor to qualify for the Child Tax Credit.’ Senator Manchin wants to go back to that. He favors a work requirement to receive the funds. We have to call out that a work requirement is just a back-door way to deny very poor families the credit. Families with children will not be able to provide the documentation to prove they are working, or that they are exempt. That is exactly what happened when Arkansas imposed a work requirement in its Medicaid program. Thousands of people lost Medicaid because they couldn’t get through to provide their proof, or they never received the notice about what they needed to do. A court stopped that program. In New Hampshire, they tried a Medicaid work requirement for a very brief period and abandoned it, because it was clear that people who were eligible couldn’t comply with the red tape requirements.

“We must not let families with children lose the Child Tax Credit because of unnecessary barriers. We must stand together and let our elected officials know that we must make this investment in children. If your member of Congress supports Build Back Better, let them know they’re backed by a powerful alliance of voters. If they don’t support it, hold them accountable. So much is at stake – we can’t stop now.”