House Budget Proposal Hurts Millions of People to Pay for Still More Breaks for the Rich

First steps have now been taken in the House and Senate towards a massive shift of the nation’s wealth away from everyday people and to the already overflowing coffers of billionaires.

Let us be clear: these first steps do not set an inevitable course. We can and must block their dangerous path.

The House Budget Committee passed along party lines a budget resolution that is the fullest expression of this extreme agenda; the Senate version may be seen as part one of that agenda. So let’s talk about the more comprehensive House budget.

To get enough votes to pass, the House Budget Committee agreed to require the drafting of legislation to cut vital services including Medicaid, the Supplemental Nutrition Assistance Program (SNAP) and education by $2 trillion or more over the next decade in order to allow $4.5 trillion in tax breaks heavily skewed towards the ultra-wealthy. The initial budget draft called for at least $1.5 trillion in program cuts, but House extremists demanded assurances that Congress would cut health care, food, education, and other basic needs programs even more deeply. The budget they would accept calls for scaling back the tax breaks if Congress fails to cut at least $2 trillion from health and other programs; if they slash even more deeply, they can pile on still more tax breaks.

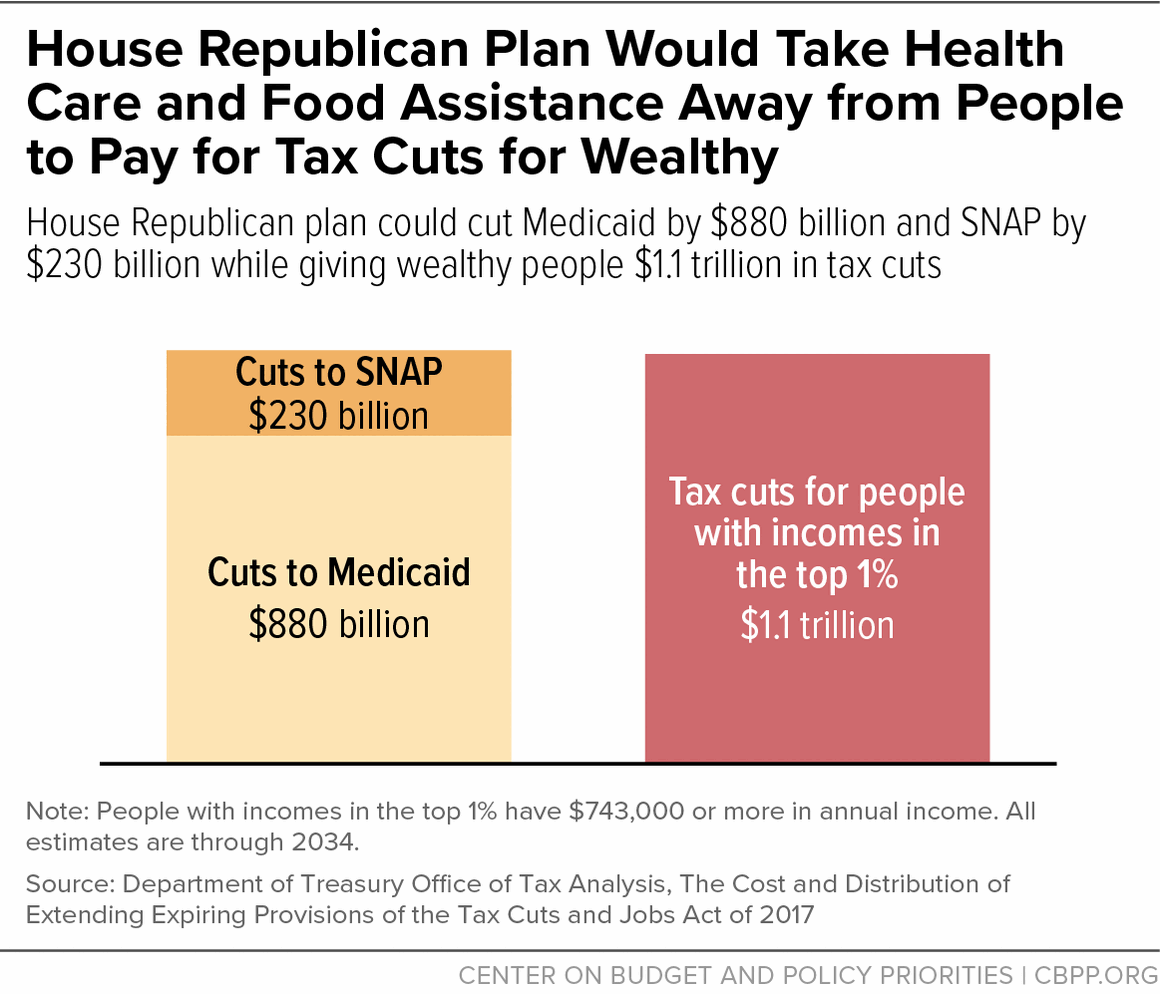

So that’s what passed in the House Budget Committee. If their budget resolution passes in the full House (they’re hoping that vote will take place during the week of February 24), it will include assignments to several House committees to come up with specific legislation to make the required program cuts. The committee that deals with Medicaid was instructed to cut at least $880 billion over ten years; the committee covering anti-hunger programs including SNAP must cut at least $230 billion. They have until March 27 to draft specific bills to achieve these drastic reductions.

So that’s what passed in the House Budget Committee. If their budget resolution passes in the full House (they’re hoping that vote will take place during the week of February 24), it will include assignments to several House committees to come up with specific legislation to make the required program cuts. The committee that deals with Medicaid was instructed to cut at least $880 billion over ten years; the committee covering anti-hunger programs including SNAP must cut at least $230 billion. They have until March 27 to draft specific bills to achieve these drastic reductions.

But bear in mind: the drafters of this budget resolution want at least $4.5 trillion in tax breaks. That would go beyond the cost of extending the expiring tax breaks originally enacted in 2017. To get there, Congress will have to agree to more cuts in health care, food, education, etc. than the $1.5 trillion initially specified. They will need at least $2 trillion in program cuts. To get there, the cuts to Medicaid and SNAP would almost certainly have to go even higher.

The budget resolution does not dictate how to make these cuts. It will be the job of the committees with jurisdiction over these programs to include specific proposals due back to the House Budget Committee by March 27. The House Energy and Commerce Committee would have to come up with at least $880 billion in cuts over a decade. Medicaid, with federal costs exceeding $600 billion per year, is the most likely target for cuts. Among the options before them are forcing Medicaid beneficiaries to document work, with the red tape required to show proof at frequent intervals expected to result in at least 36 million people losing Medicaid, even if they are working or would be exempt from work requirements because of disability or caregiving responsibilities. Other proposals to cut could scale back the number of poor people eligible for Medicaid because of the expansion made possible by the Affordable Care Act, which has added 20 million people to the Medicaid program, or could cap federal spending for Medicaid, which could also result in tens of millions of people losing Medicaid coverage. Because Medicaid costs are a shared federal-state responsibility (with the federal share averaging over 70 percent), big reductions in federal Medicaid spending will place a great burden on state budgets.

It is expected that most – or all — of the $230 billion in cuts coming from Agriculture programs will come from the SNAP nutrition program. Some of the proposals to cut would reduce benefits for all of the 40 million SNAP beneficiaries. One particularly harsh proposal from the Republican Study Committee would slash the current very modest per-person/per-day SNAP benefit of $6.20 down to only $4.80 per person per day – such a drastic cut would slash spending by $250 billion over ten years. Cuts could also drop some people from SNAP altogether, by subjecting more people to the time limit of only three months of SNAP benefits over three years if they cannot document work.

The graphic above, thanks to the Center on Budget and Policy Priorities, shows that the cuts in health care and food cost about the same as the tax breaks going to people with incomes of more than $743,000 in annual income – the richest 1 percent.

Taking food and medical care away from people with very low incomes will cost lives. A recent estimate of the significant benefits of expanding Medicaid to millions of poor people previously excluded estimated that 27,400 lives were saved from 2014-2022 because of new access to medical care. It is not an exaggeration to suggest that thousands of lives will be lost if millions are cut off Medicaid.

Similarly, a Massachusetts studyof young children found that when SNAP benefits were increased in response to economic hardship, significantly more children were described as “well.”* Drastically reducing SNAP benefits, especially in a time of high food costs, will worsen child health.

These are not “savings.” They are unaffordable, unconscionable costs. This budget asks the poorest families to pay with their health and even their lives to enrich the wealthiest among us.

On average, close to one-quarter of the people in congressional districts nationwide (23.6 percent) receive Medicaid. Over 41 million people received SNAP nationwide in FY24; with data also available by congressional district. Every member of Congress needs to know how important these programs are for their own constituents.

In requiring committees with jurisdiction to come up with legislation making cuts, the goal is for these bills to be able to pass the Senate with a simple majority using the budget reconciliation process. That can happen if both House and Senate agree on a budget resolution providing the instructions to committees on how much they should cut. So far, they have not put forward identical budget resolutions.

There will be tremendous pressure from the Trump administration for the House and Senate to agree on a budget resolution. People who care about people’s health and hunger, and the costs to their states if the federal government walks away from its responsibilities, need to make sure their members of Congress know how much is at stake. The House vote on its draconian budget is expected during the week of February 24, on their return from this week’s recess. This week would be a very good time to look up the numbers of people relying on Medicaid and SNAP in your congressional district, and to tell your member of Congress to be the representative your community needs by voting no.

Here’s a template message you can deliver to your representative while they are home on recess:

I am deeply concerned about the scale of cuts in the House FY25 Budget resolution – and specifically that millions of people could lose access to health care or face increased health costs because of deep cuts to Medicaid including many in our Congressional District – most of whom are children, low-income seniors, people with disabilities, or caregivers. In particular, I am concerned about proposals that increase paperwork burdens for Medicaid participants including many in our Congressional District. I am also concerned with reports that Congress is looking to move budget reconciliation legislation that would deeply cut and restructure food assistance/SNAP benefits, impacting the ability of SNAP participants in our Congressional District to put food on the table at a time when many families are struggling with the high cost of food. Please reject budget proposals that take food or health care away from people to give tax breaks to the wealthy.

For more resources, see CHN’s Budget Resource Library, State and Local Data Resource Library, updated budget and tax toolkit for local groups (Winter 2025), and CHN/partner events joint calendar – which includes the proposed GOP budget timelines.

*Note that this corrects the original text, which described the study as a report during the pandemic; it actually studied a benefit increase that occurred in response to the Great Recession in 2009. We regret the error.